ALGOSTOX TRADING

Making markets. Making finance.

FINANCIAL MARKETS

Quantitative approach is the cornerstone of our operations. We use it to create margin, save on execution, reduce operational expenses and manage risk.

- Quantitative strategies

- Trade execution

- Advanced pricing

- Risk management

STATE-OF-THE-ART ANALYTICS

Our cutting-edge research crystallizes into state-of-the-art analytic tools that allow to act when others react. Calibrating into current market conditions these tools are just what every trader needs to boost pricing and execution capabilities.

LEADING RESEARCH

Algostox is engaged in innovative research that revolutionizes the way we think about financial markets. How does price form, what is volatility, and why will supply never balance demand – read about it in our research releases.

QUANTITATIVE TRADING

TRADING STRATEGIES

Betting against deficient instruments

Financial markets are flooded with complex instruments that have hidden inherent deficiencies. Inherent deficiencies guarantee that these instruments will underperform in the long term. We find such instruments and bet against them. In the meantime, we make sure the strategy is adequately capitalized and has proper risk controls until the markets discover deficiencies the hard way.

Quantitative HFT strategies

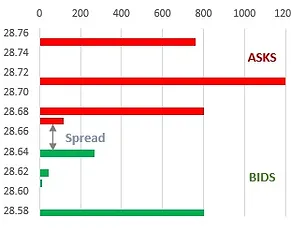

We do not forecast or predict price movements. Instead, we focus on execution and position management. When we obtain a security at the lowest possible price, we are quite sure to liquidate it in the market for profit. Position management ensures that our positions are assembled from the cheapest inventory in the markets and that breakeven point remains below the market price.

Optimization strategies

The firm’s goal to produce superior returns is marked against the undertaken level of risk. To serve this goal investment strategies are optimized with the firm’s proprietary methodology aiming for efficient use of funds and reduction of transaction costs.

RISK MANAGEMENT

The firm’s trading approach does not allow to use traditional risk management models that are normally employed by financial institutions. To ensure adequate and proper risk management the firm develops risk models in-house. Each model is tailored to the strategy it controls and is validated to demonstrate adequate ability to capture actual risk generated by the strategy.

TECHNOLOGY

Unlike other companies with similar investment profile Algostox intentionally does not invest in latest HFT technological developments. The firm pursues only the opportunities that are based on inherent properties of financial markets a

TRADING COUNTERPARTIES

If you do not have a counterparty account with Algostox Trading and would like to begin transacting with us, please contact us at +1 (212) 739-0506 or use the Contact form to request one.

Algostox is an active participant in securities with low liquidity. Our proprietary tools based on latest breakthroughs in financial theory allow us to price just about any financial instrument in the world, as well as compose new ones. Because we are confident in our pricing, we stay active in the markets no matter how rough they get.

Algostox constantly quotes securities looking for matching prices from our trading counterparties. These quotes are published in Counterparty Portal and are available only to firms that have an established relationship with us.

ANALYTIC SUITE

TAKE CONTROL OF YOUR TRADING WITH POWERFUL ANALYTICS

Trading | Sales | Portfolio management | Risk control | Reporting

- Stocks and bonds pricing

- Illiquid and oversize trade pricing

- OTC derivatives on illiquid underlying

- Immediate volatility and correlations

- Trade execution optimization

RESEARCH

PIONEERING INNOVATION IN FINANCE

LIQUIDITY AND PRICING

Quantum nature of financial markets

As we look at the details of price formation and order execution, we find that every trade in financial markets represents an elementary act of price measurement. This lead us to formulation of quantum theory of price formation.

MARKET VOLATILITY

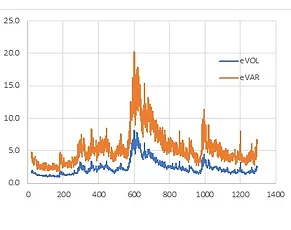

How much is the current volatility?

Traditional measures used by financial companies to determine volatility fail to reflect the current volatility. By treating the market as a statistical ensemble, we are able to measure current volatility, which reacts to market changes many times faster than any of the traditional measures.

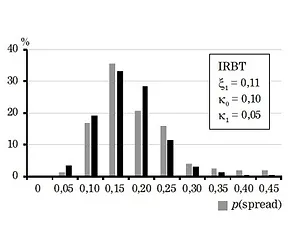

RISK MANAGEMENT

Adjusting for liquidity

Majority of instruments in financial world are not very liquid. Data gaps, mismatch and information scarcity make the traditional models useless. How do we evaluate market risk if we have illiquid positions in the portfolio?

Contacts

641 Lexington Ave, fl. 15

New York, NY 10022

United States

info@algostox.com

+1 212 739 0506